Cyprus government in an effort to boost the promising sector of Film production in the sunny island has introduced in 2018 a film scheme with a package of incentives encouraging international producers to choose Cyprus as their film destination. In short, production companies will be able to choose between cash rebate or tax credit, but also benefit from tax discounts on equipment and infrastructure expenses but also VAT returns on expenditure in scope.

Cyprus.

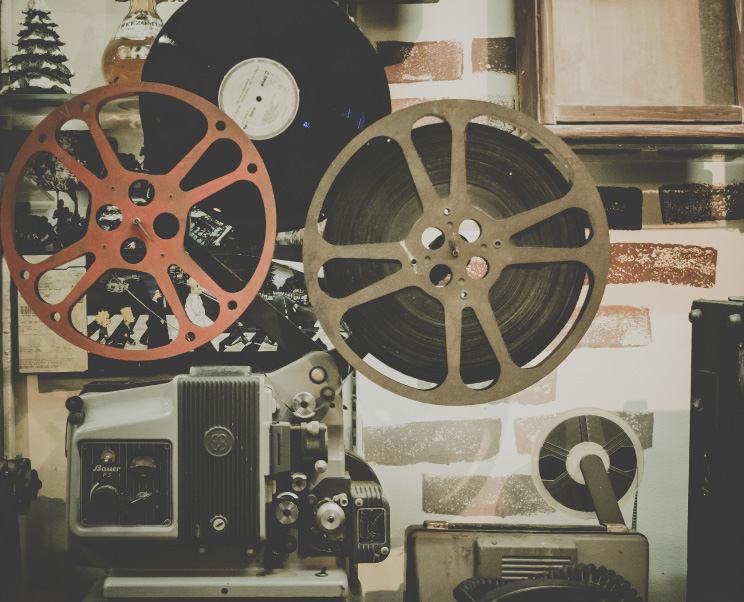

The Cyprus landscape is well known for its Mediterranean characteristics combining vibrant sandy but also rocky shores, wild mountain range and grasslands. With hundreds of historical sights from various time periods the whole scenery offers amazing opportunities.

Cyprus historical monuments include ancient Greek theatres, tombs, settlements, medieval castles, churches, bridges, defense city walls and many other amazing spots. Cyprus’s rich history and rich scenery provides opportunities for magnificent captures and together with the all year-round sun make the place an ideal production destination.

Incentives in short.

Cash rebate.

Rebate of up to 35% of eligible expenditures incurred in Cyprus will be granted, where the amount will depend on the score of the production at the cultural test.

The rebate will be given once filming is completed, on receipt of the audit report and its review by the committee

Tax credit.

As an alternative to cash rebate, tax credit, offers a reduction of the corporate tax liability of the company responsible for the implementation of a production, with the same criteria that apply for cash rebate.

The sum of the tax credit against the taxable income shall not exceed 50% of the Applicants’ taxable income for the tax year within which the production is made.

The tax credit, to the extent that it is not granted due to the above percentage restriction, shall be carried forward and be given within the next five years, subject to the above percentage restriction.

Tax discount for investment in infrastructure and equipment.

Any small and medium-sized enterprise subject to a tax liability in Cyprus investing in cinematographic infrastructure and technological equipment will be entitled to deduct the amount of its investment from its taxable income.

The aid may not exceed 20% of the qualifying production expenditures in the case of small enterprises and 10% of the qualifying production expenditures in the case of medium-sized enterprises.

Investment in the case of equipment should remain in the territory of Cyprus for a period of at least 5 years.

VAT refund on production expenditures.

The production company is entitled to a tax refund for expenditures incurred in Cyprus by natural or legal persons from third countries and which are related to the implementation of productions.

Value Added Tax rates in the Republic of Cyprus are 19%, 9% and 5% on all products and services provided in the Republic of Cyprus and 19% and 5%, on all taxable imports.

Download here the comprehensive Cyprus Film Scheme guide.

Qualifying categories.

Qualifying categories include Long Films for cinemas of at least 60 minutes duration. Television films, TV series or mini-series, Animations, Documentaries, Transmedia and Crossmedia productions and finally reality programs which directly or indirectly promote Cyprus and its culture.

In our Library section you can download the comprehensive Cyprus Film Scheme guide.

You may also contact one of our advisors here.